Hurun China 500 Most Valuable Private Companies 2021

The Hurun Research Institute today released the Hurun China 500 Most Valuable Private Companies 2021, a list of the Top 500 China non-state-controlled enterprises ranked according to their value.

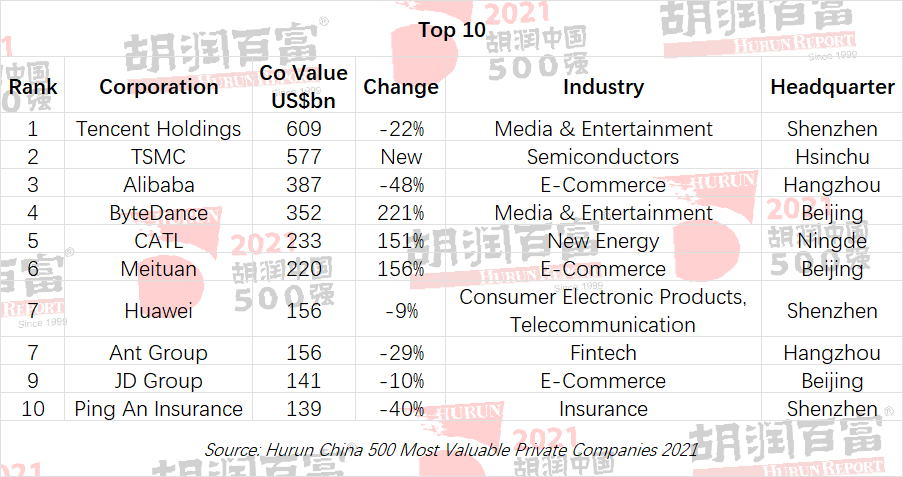

Tencent is officially the most valuable company in China, heading the Hurun China 500 with a valuation of US$609bn

Hurun China 500 cut-off rose 39% to US$5bn, more than double that of 2 years ago

Semi-conductor giant TSMC was second with a value of US$577bn

Alibaba halved in value, dropping down one place to third

ByteDance’s value tripled last year, rising five places to 4th

Battery-maker CATL shot up 6 places to break into the Top 10 for the first time at fifth place, with its value rising 2.5 times to US$233bn

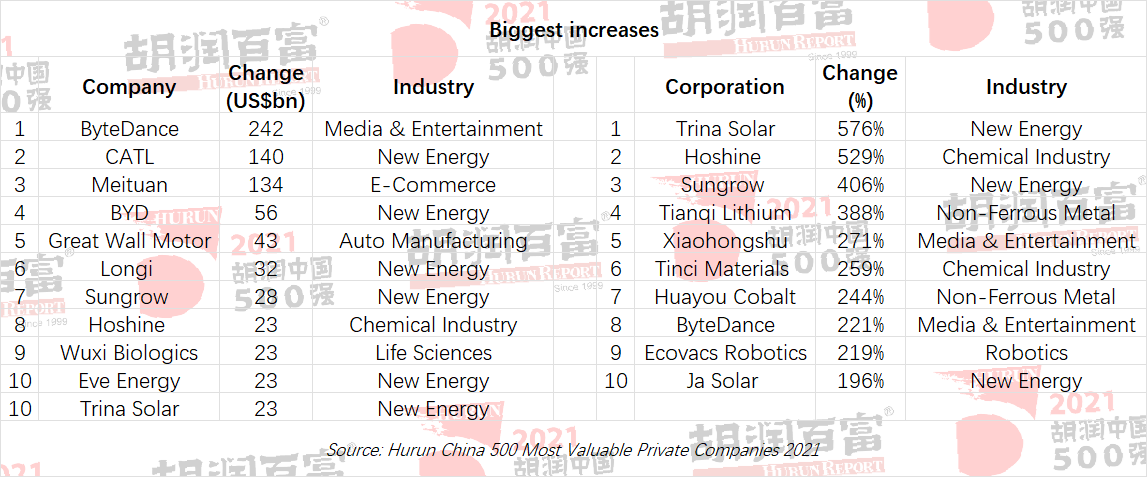

34 companies more than doubled in value, led by Bytedance, CATL and Meituan

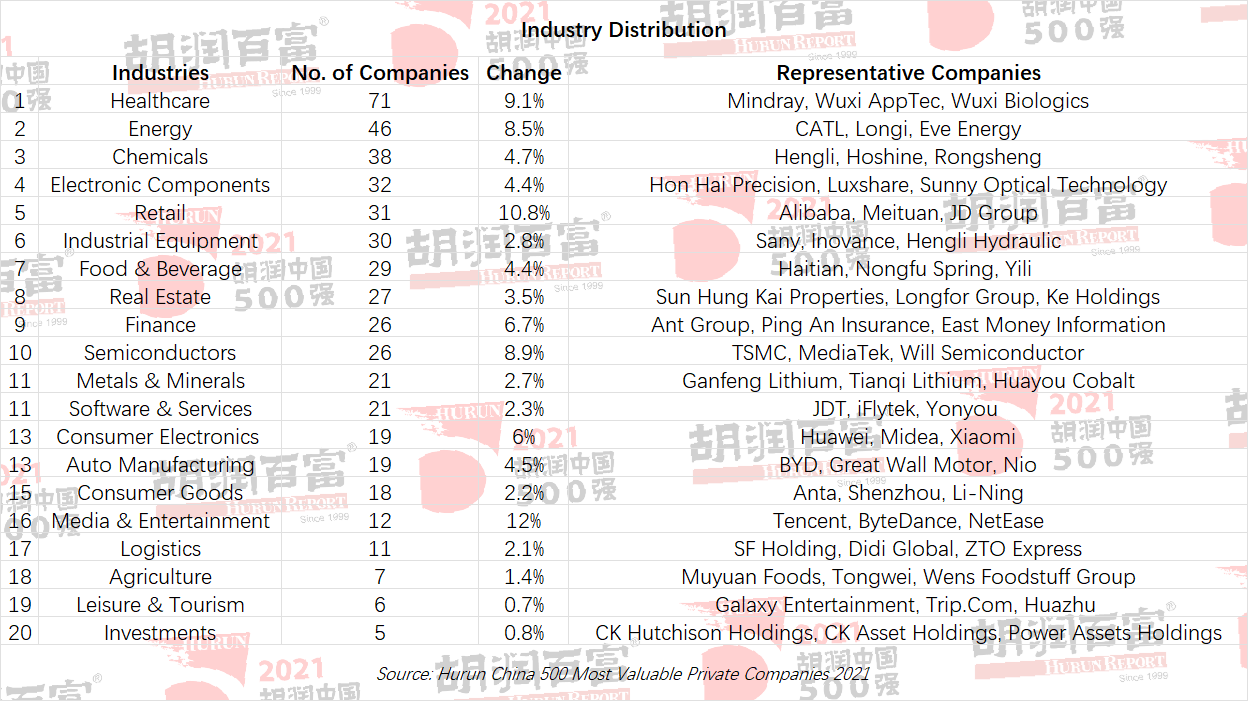

Healthcare and energy grew significantly, becoming the top two sectors

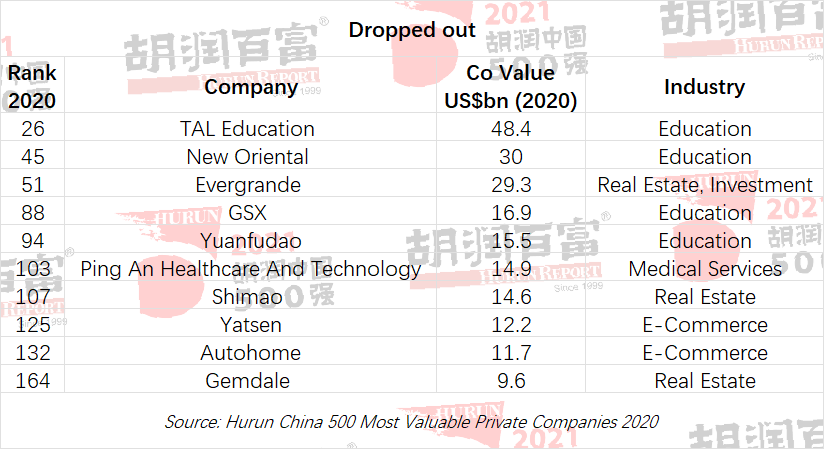

Traditional medicine and pharmaceutical retail, real estate and education were the biggest losers

By city. Shanghai was up 2 to 69, overtaking Beijing for the first time, as the city with the most Hurun China 500. Beijing was down 25 to 68, ranked second. Shenzhen remained 3rd with 45, followed by Hangzhou and Hong Kong with 30 each and Taipei with 24. Half of the Hurun China 500 are concentrated in these 6 cities.

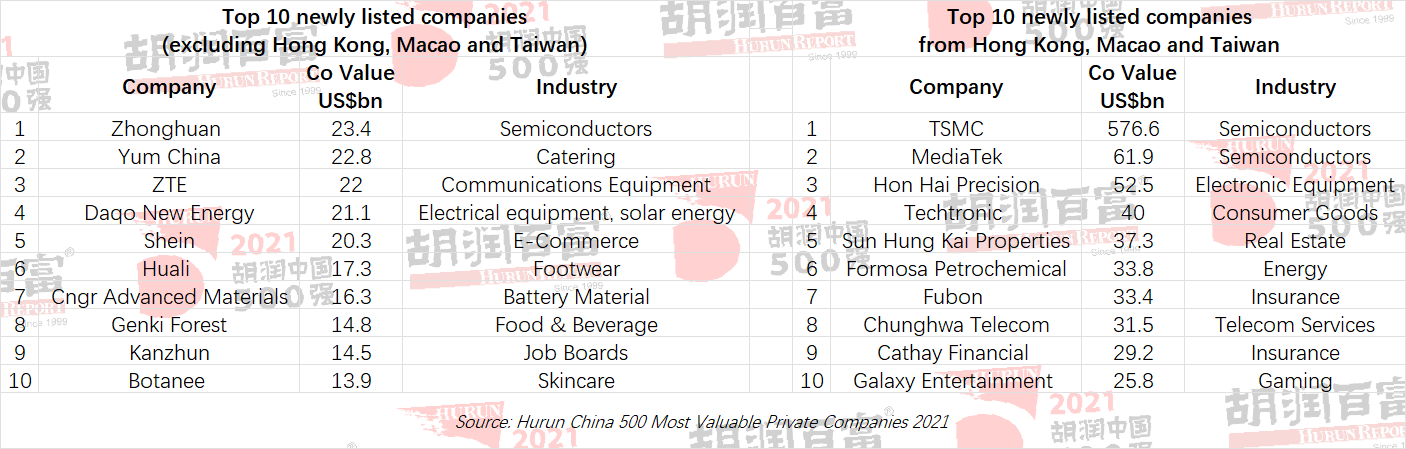

176 companies made the Hurun China 500 for the first time, mainly from energy, chemicals and healthcare. 70 of these were from Taiwan and Hong Kong.

Together, the Hurun China 500 had annual sales of US$3.75tn and 11 million employees. Curiously, 24 have an annual revenue of less than US$150mn.

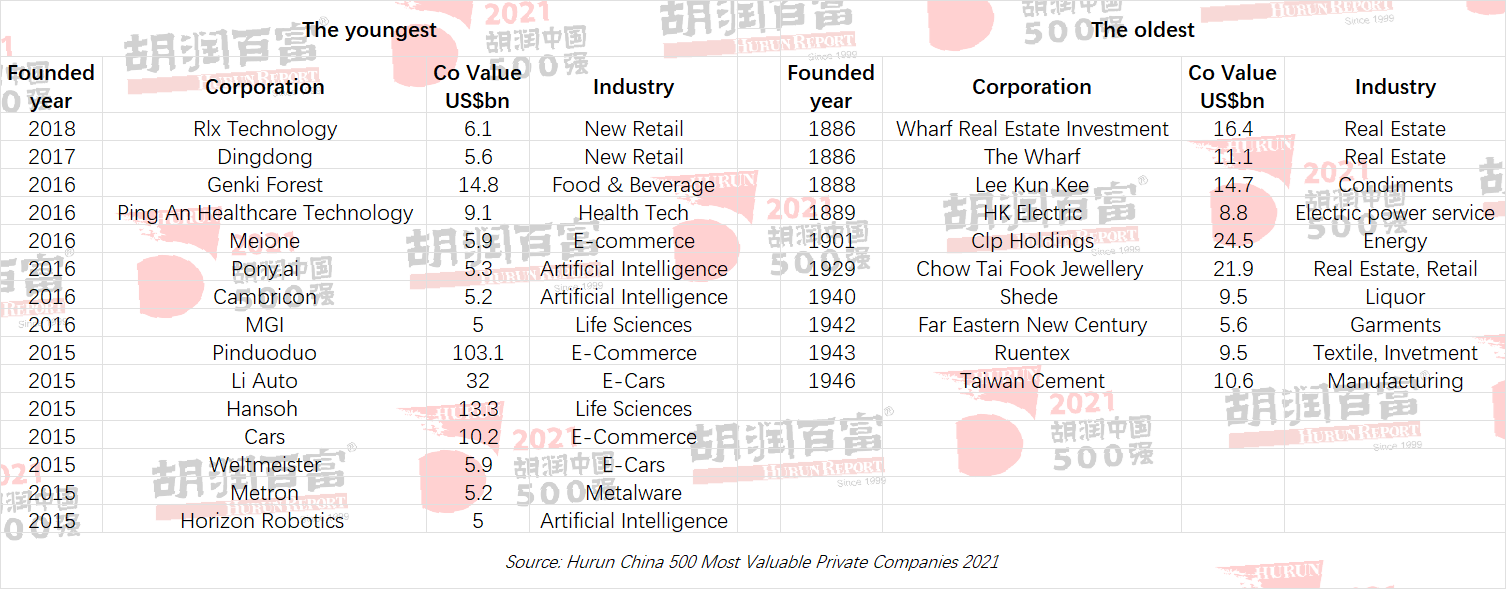

On average, the Hurun China 500 are 25 years old, ie founded in 1996. 34 have a history of more than 50 years, of which 5 have a history of more than 100 years, all from Hong Kong; 8 were established less than 5 years ago.

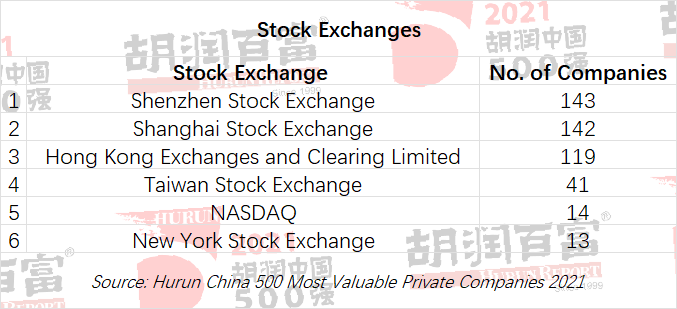

88% are listed companies, up 2%. Shenzhen and Shanghai stock exchanges remain the preferred listings of the Hurun China 500, with 143 and 142, followed by HKEX with 119. 27 are listed in the US.

19 individuals founded or control more than one Hurun China 500, led by Li Ka-shing & family with 5

Nearly 10% of the Hurun China 500 are unicorns from the Hurun Global Unicorns 2021

The Hurun Research Institute today released the Hurun China 500 Most Valuable Private Companies 2021

(19 January 2022, Shanghai) The Hurun Research Institute today released the Hurun China 500 Most Valuable Private Companies 2021, a list of the Top 500 China non-state-controlled enterprises ranked according to their value. The cut-off used for listed companies was 19 November 2021, and the valuation of non-listed companies was estimated with reference to listed companies from the same industry. This is the third year of the Hurun China 500.

As of 19 November 2021, Nasdaq was up 35% year-on-year, the Shenzhen Component Index was up 7%, the Shanghai Composite Index was up 6%, and the Hang Seng Index was down 5%.

The threshold for the Hurun China 500 Most Valuable Private Companies 2021 increased by US$1.4bn (39%) over the previous year, reaching US$5bn. The total value of the list increased by US$1.6tn (18%) over the previous year to US$10.3tn, equivalent to about 60% of China's GDP in 2021. The average value increased by US$3.1bn (18%) to US$20.3bn. 370 companies saw their value increase, of which 176 were ‘new faces’; 9 companies have the same value as the previous year; 126 companies decreased in value; and 180 companies fell off the list. 56% are B2B businesses and 44% are consumer-focused. 77% offer physical products and 23% offer software or services.

Hurun Report Chairman and Chief Researcher Rupert Hoogewerf said: “The companies from the Hurun China 500 are the ‘backbone’ of China's private sector, wielding significant economic influence. Between them, they have annual revenues of US$3.75tn, equivalent to a quarter of China's annual GDP and employ 11 million people. Despite the impact of Covid, they have still managed to grow, with their average value more than doubling to US$20bn since the pandemic started two years ago and their total value increasing by US$4.7tn to US$10.3tn.”

“This year, the threshold to make the Hurun China 500 was US$5bn, up 39% from last year and more than double that of two years ago. At this rate, the cut-off might well be closer to US$10bn in five years.”

“Which companies are up and which are down tell the story of the changes in the economy. Energy, chemical and healthcare industries rose rapidly, while traditional medicine and pharmaceutical retail, real estate and education led the list of companies that dropped off.”

“Since the outbreak of Covid, Alibaba and Ping An Insurance have seen their value drop by US$203bn and US$94bn.”

“The average age of the Hurun China 500 is just 25 years old, 38 years younger than the average age of Hurun Global 500.”

This is a brief English language summary of the full Chinese press release which can be found at www.hurun.net. For media enquiries please contact our public relations team whose contact details can be found at the end of this report.

Top 10

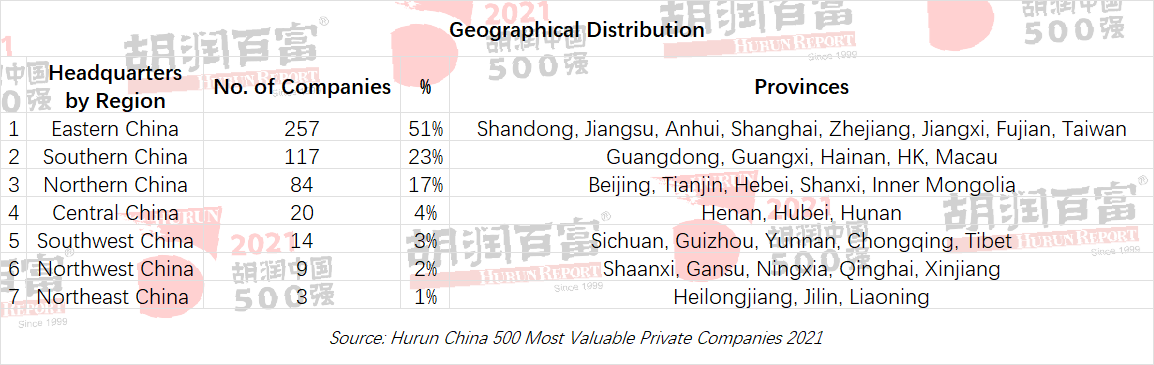

Geographical Distribution

In terms of cities, Shanghai pipped Beijing at the post, whilst Shenzhen remained the third.

In terms of provinces, Guangdong ranked first with 87. This year, companies from Hong Kong, Macao and Taiwan were included. Guangxi, Hainan, Heilongjiang, Jilin, Tibet and Macau were the only places without a Hurun China 500.

The Yangtze River Delta region was top with 35% or 177 of the total, followed by the GBA with 117 or 23%.

Industry Distribution

Biggest increases

New to the List

Dropped out

Biggest drops

So, How much Revenues do they have?

The revenue of the Hurun China 500 totaled US$3.75tn, with an average of US$8bn.

And how many staff do they employ?

The Hurun China 500 employs 11 million staff, or 22,000 per company. 262 of the Top 500 companies have fewer than 10,000 employees. 20 have more than 100,000 employees.

Established time

Stock Exchanges

About Hurun Inc.

Promoting Entrepreneurship Through Lists and Research

Oxford, Shanghai, Mumbai, Sydney, Paris

Established in the UK in 1999, Hurun is a research, media and investments group, promoting entrepreneurship through its lists and research. Widely regarded as an opinion-leader in the world of business, Hurun generated 6 billion views on the Hurun brand last year, mainly in China and India.

Best-known today for the Hurun Rich List series, telling the stories of the world’s successful entrepreneurs in China, India and the world, Hurun’s two other key series include the Hurun Start-up series and the Hurun 500 series, a ranking of the world’s most valuable companies.

The Hurun Start-up series begins with the Hurun U30s, an awards recognizing the most successful entrepreneurs under the age of thirty, and is today in seven countries. Next up are Hurun Cheetahs, Chinese and Indian start-ups with a valuation of between US$300mn to US$500mn, most likely to go unicorn with five years. Hurun Global Gazelles recognize start-ups with a valuation of US$500mn to US$1bn, most likely to go unicorn within three years. The culmination of the start-up series is the Hurun Global Unicorn Index.

Other lists include the Hurun Philanthropy List, ranking the biggest philanthropists, the Hurun Art List, ranking the world’s most successful artists alive today, etc…

Hurun provides research reports co-branded with some of the world’s leading financial insitutions, real estate developers and regional governments.

Hurun hosted high-profile events in the last couple of years across China and India, as well as London, Paris, New York, LA, Sydney, Luxembourg, Istanbul, Dubai and Singapore.

For further information, see www.hurun.net.

For media inquiries, please contact:

Hurun Report

Porsha Pan

Tel: +86-21-50105808*601

Mobile: +86-139 1838 7446

Email: porsha.pan@hurun.net

Grace Liu

Tel: +86-21-50105808

Mobile: +86 136 7195 4611

Email: grace.liu@hurun.net

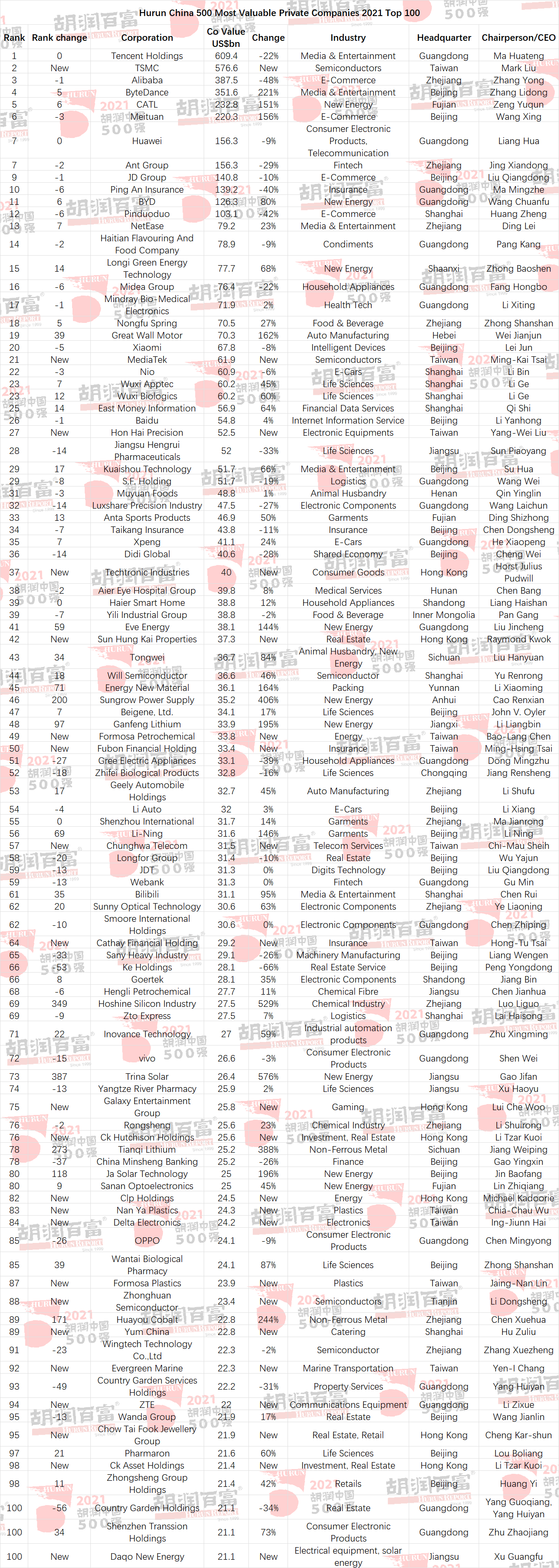

Hurun China 500 Most Valuable Private Companies 2021 Top 100

For the full list, please see www.hurun.net